Native Token Roles & Utility

$OMNI is the native token powering the Omni protocol. This section covers the roles and utility aspects of the $OMNI tokenomics. The token serves the following functions within the network:

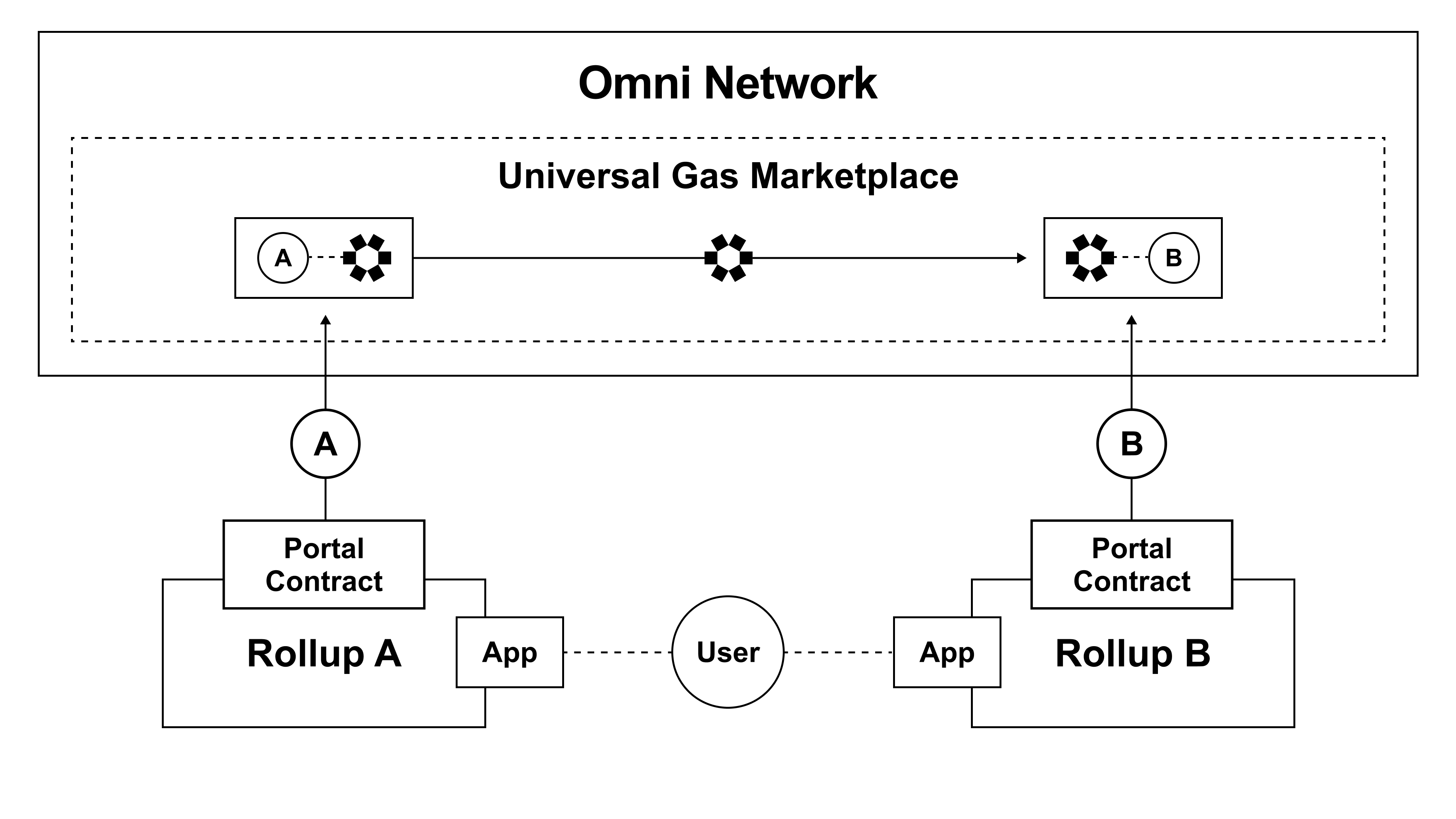

Cross-Rollup Gas Fees

$OMNI is used as a payment mechanism to compensate relayers for submitting cross-rollup messages to destination networks. Relayers maintain an inventory of gas assets for all supported rollups and accept payments in the form of $OMNI. This allows Omni to establish a universal gas marketplace that simplifies the process of gas payments across all rollups for end users.

Omni EVM Gas Fees

$OMNI also serves as the native gas asset that powers the Omni EVM. The Omni EVM functions as a global orchestration layer for application instances across multiple rollups, allowing users and developers to initiate transactions and manage applications on any rollup from a single source. $OMNI provides an anti-sybil mechanism for transactions submitted to the Omni EVM, deterring spam and malicious activities such as denial-of-service attacks. $OMNI also serves as compensation for Omni validators investing computational power for transaction processing and network security. Users can choose to pay higher $OMNI fees to validators for priority transactions, thereby establishing a fee market based on $OMNI.

Network Governance

At launch, the initial Omni protocol will provide basic cross-rollup messaging functionality across a specified set of rollups. As Omni matures, $OMNI stakeholders will be responsible for various governance decisions such as protocol upgrades and additional developer features.

Reinforced Security

Omni achieves stronger and more stable security guarantees than existing interoperability protocols by deriving its cryptoeconomic security from restaked $ETH. Omni extends its security model further by incorporating staked $OMNI using a dual staking model. Effectively, the total cryptoeconomic security of Omni is determined by the combined value of restaked $ETH and staked $OMNI.

By implementing this dual staking model, Omni’s security scales across two dimensions. Restaked $ETH anchors Omni’s security to Ethereum L1, enabling it to grow in line with Ethereum’s own security budget. The addition of staked $OMNI builds upon this base, expanding Omni’s security alongside its own network activity. Collectively, these two complementary mechanisms provide robust and dynamic security guarantees for Omni, setting a new standard for secure interoperability for the Ethereum ecosystem.