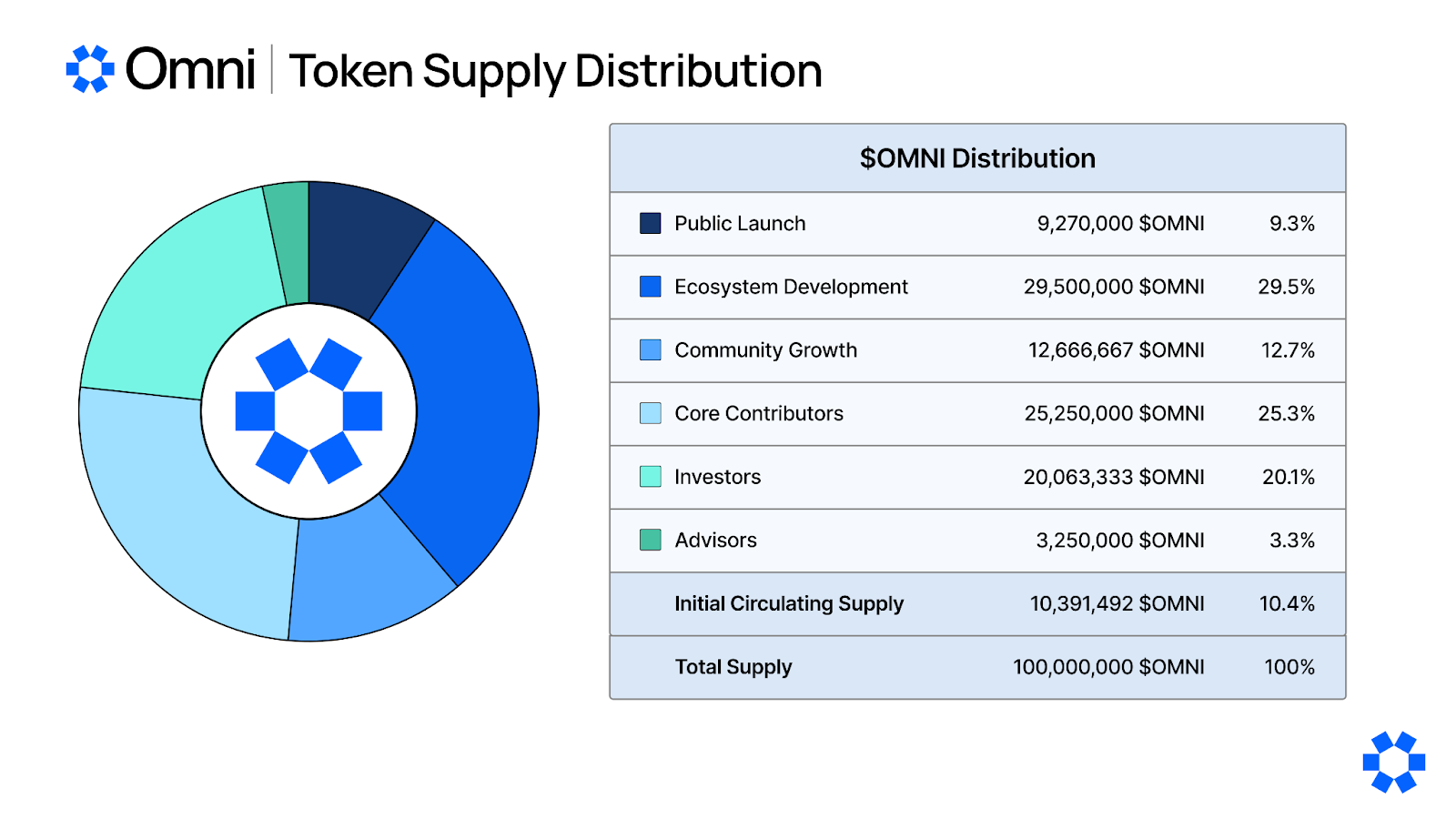

Token Supply & Distribution

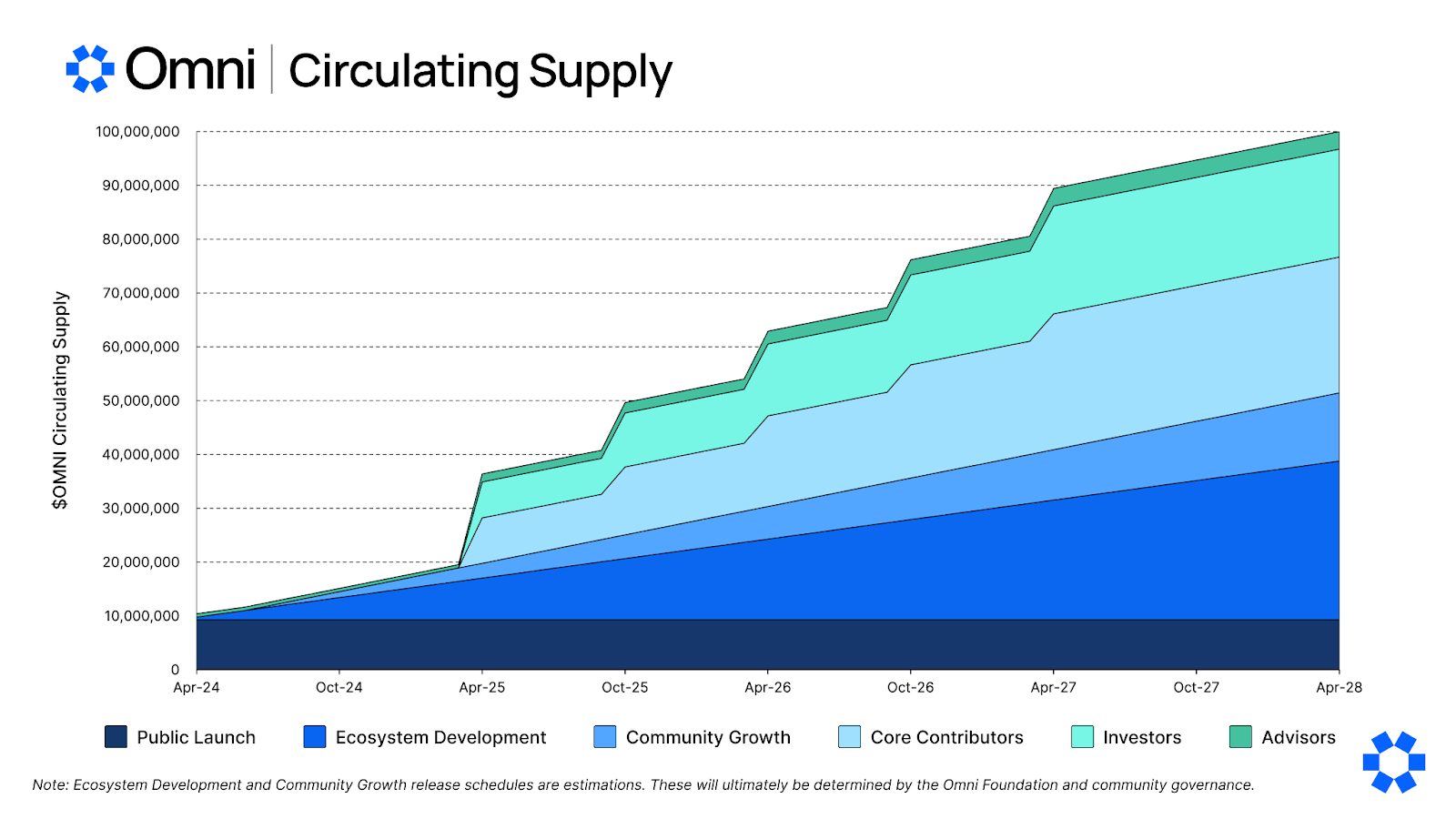

$OMNI is an ERC-20 token launched on Ethereum L1 (deployed to 0x36e66fbbce51e4cd5bd3c62b637eb411b18949d4) with a maximum supply of 100,000,000. This section covers the supply & distribution of $OMNI's tokenomics.

At genesis, $OMNI had a circulating supply of 10,391,492 (10.39% of total supply). $OMNI is distributed across the following categories:

Public Launch

9.27% – 9,270,000 $OMNI

The Omni Foundation retroactively rewarded the Omni community and its partners across the Ethereum ecosystem with 3,000,000 $OMNI (3% of total supply) during the $OMNI Genesis airdrop. More details on the Genesis airdrop can be found here. The remaining Public Launch tokens are used for public launch pools and liquidity.

Ecosystem Development

29.5% – 29,500,000 $OMNI

Developers building with Omni are the key to ushering in a new generation of globally accessible applications across all Ethereum rollups. Omni is committed to fostering a thriving developer community building on the Omni EVM and across Ethereum’s rollup ecosystem. $OMNI tokens reserved for the Ecosystem Development category will be initially used at the discretion of the Omni Foundation. In the future, this responsibility will be transitioned to token holder governance. At genesis, 496,492 $OMNI entered the circulating supply for early validator rewards and network bootstrapping.

Community Growth

12.67% – 12,666,667 $OMNI

Future initiatives, such as grant funding and other relevant programs, will be vital for Omni’s growth and adoption. Community Growth tokens will be initially used at the discretion of the Omni Foundation. In the future, this responsibility will be transitioned to token holder governance.

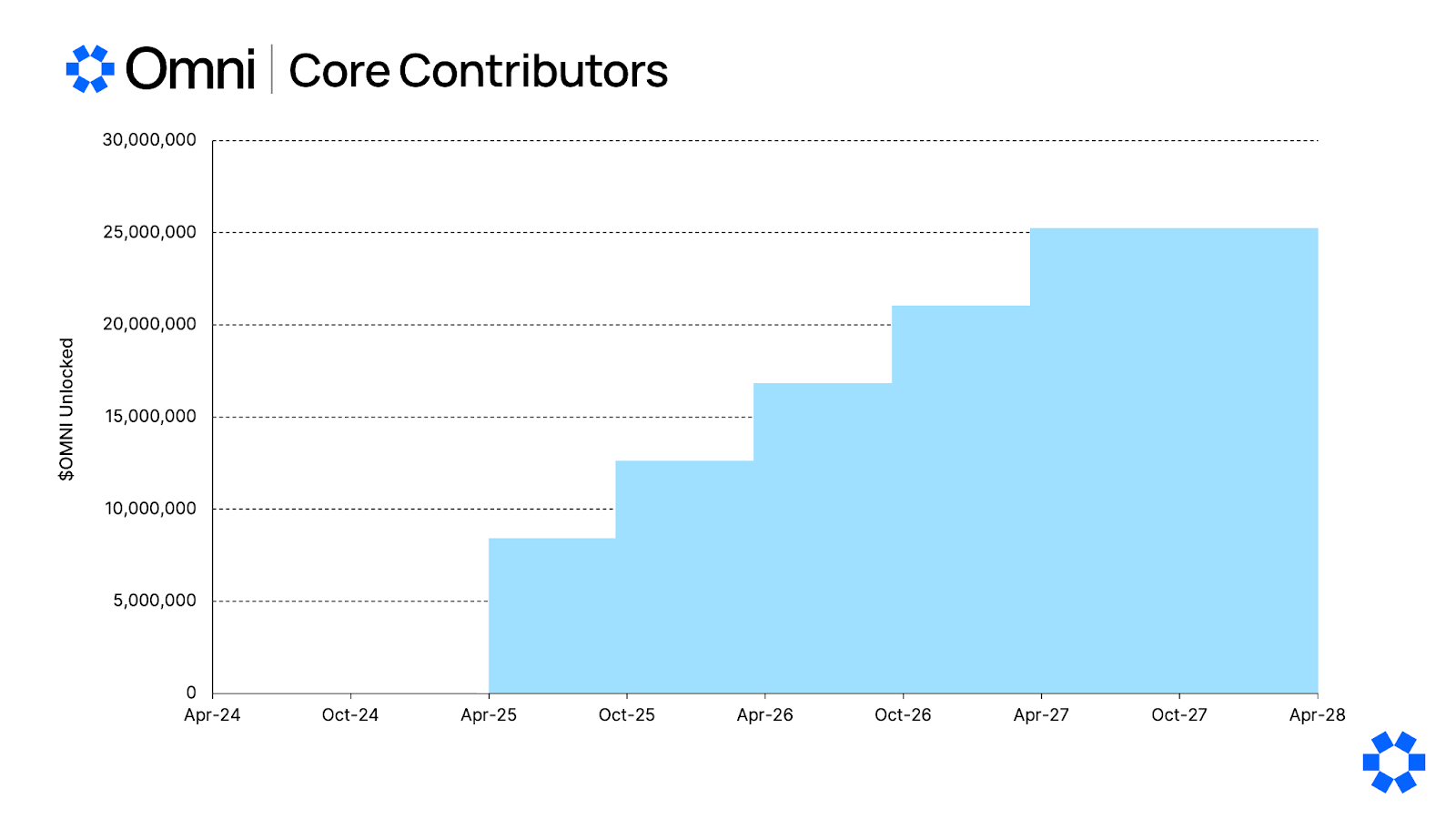

Core Contributors

25.25% – 25,250,000 $OMNI

A portion of $OMNI supply is allocated to the protocol’s current and future contributors. Individual contributors are subject to a 4 year vesting period (beginning at the date of joining the project) with a 1 year cliff for ¼ of their total tokens followed by stepwise unlocks every 6 months for the remaining ¾ of tokens. All tokens allocated to core contributors are subject to a 3 year unlock schedule after the token generation event that includes a 1 year cliff for ⅓ of the total tokens followed by stepwise unlocks every 6 months for the remaining ⅔ of tokens.

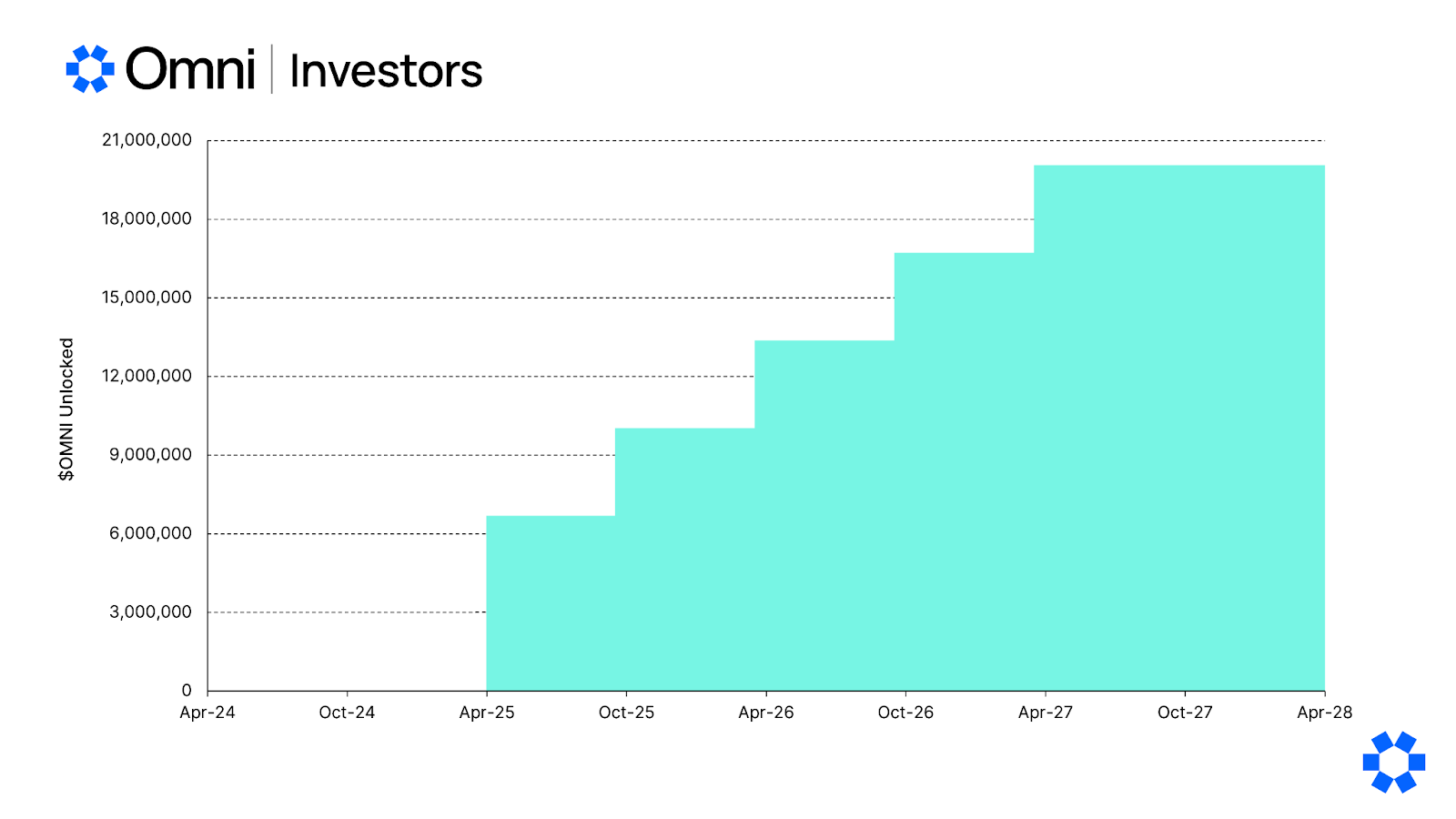

Investors

20.06% – 20,063,334 $OMNI

Since its founding, Omni Network has enjoyed the backing of influential investors from the Ethereum community, whose knowledge and strategic advice have significantly contributed to Omni's expansion and evolution over the past two years. All tokens allocated to investors are subject to a 3 year unlock schedule that includes a 1 year cliff for ⅓ of the total tokens followed by stepwise unlocks every 6 months for the remaining ⅔ of tokens.

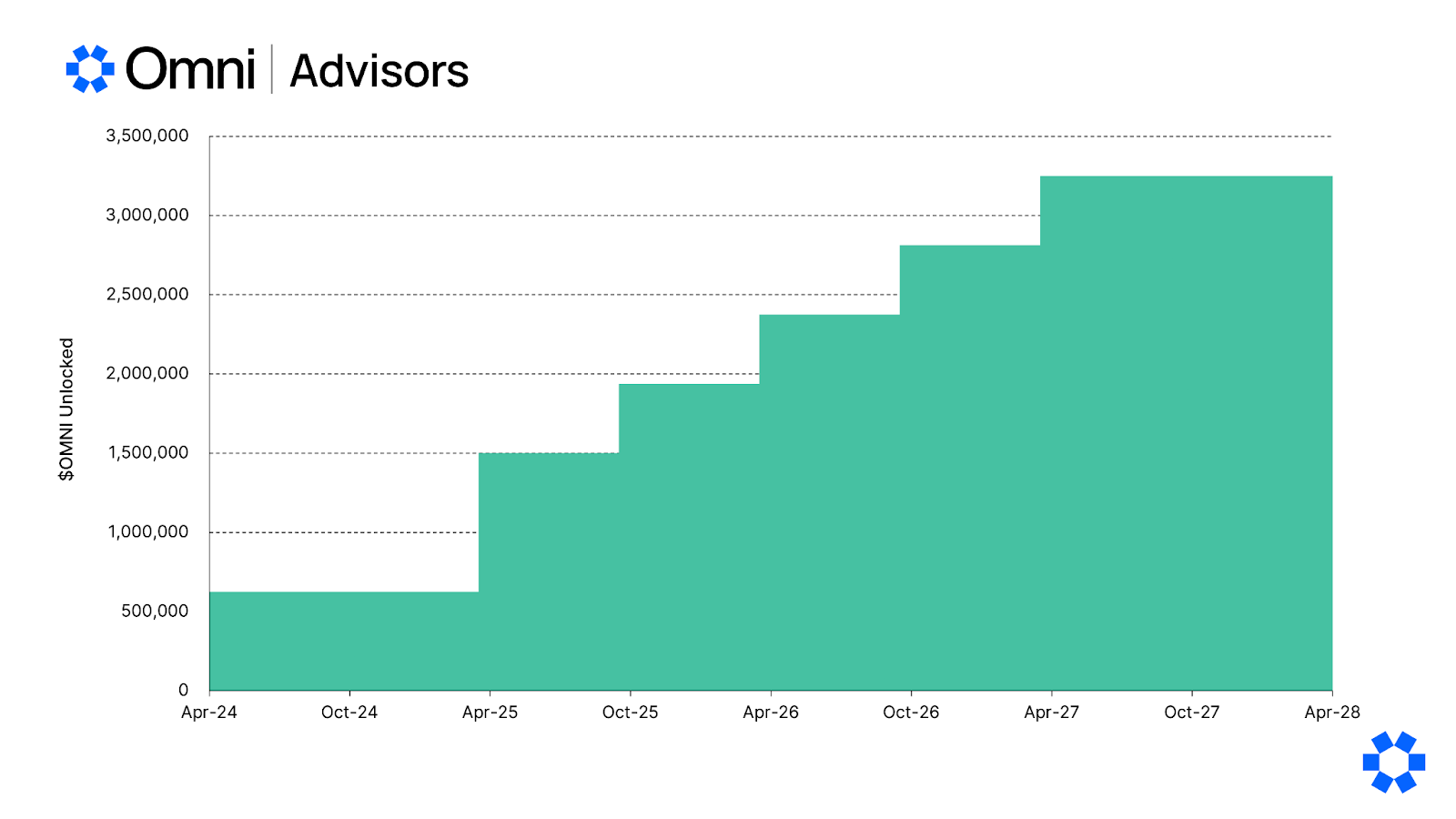

Advisors

3.25% – 3,250,000 $OMNI

The final portion of $OMNI is allocated to advisors for expertise and guidance on network development. 625,000 $OMNI will be unlocked at genesis while the remaining tokens will be subject to a 3 year unlock schedule that includes a 1 year cliff. 875,000 $OMNI will be unlocked after the 1 year cliff, followed by 437,500 $OMNI unlocked every 6 months for the remaining 2 years.

Total Supply

Locked and/or unvested tokens for the Core Contributors, Investors, and Advisors categories cannot be staked. $OMNI unlocks will be complete across all categories three years after token genesis. The Ecosystem Development and Community Growth allocations will be unlocked at genesis but will enter circulation at the discretion of the Omni Foundation and community governance. Inflation for validator rewards after the third year will be determined by community governance.